This post was also published on Forbes.com.

I first read The 7 Habits of Highly Effective Teens in high school after it was recommended by the librarian (thanks Mrs. Webster!). Pretty soon I read The 7 Habits of Highly Effective People and many other similar business and self-help like books. Recently I noticed many other business tips really stem from the book and decided to revisit the principles and see how they can be applied to real estate investing.

Habit 1: Be Proactive

Covey introduces the idea of Circle of Influence and Circle of Concern in his book. Imagine two concentric. The bigger circle, the Circle of Concern, is all of the things you can worry about going wrong in real estate: contractors not showing up, water heater breaks, investor backing out of commitment. Inside that circle is a slightly smaller one, the Circle of Influence, for items that you have control over.

Life is 10% what happens to you and 90% how you react. As investors we must be proactive, control the controllable to expand our Circle of Influence. Accept responsibility for situations and take initiative to make things better. Waiting for problems to happen or the woe is me kind of attitude will get you nowhere.

Habit 2: Begin With the End in Mind

This goes far beyond how you envisioning how you want your fixer to look at the end or conclusion of an investor pitch meeting. You also have to have a picture in mind what you want your life to look like in the end and your relationships with the people that matter so you don’t end up working aimlessly. Lots of motivational gurus talk about “what’s your why” or “finding your purpose” ad nauseam and the reason they do it is because it’s important. What is your personal mission? Spread the gift you are put on this world for.

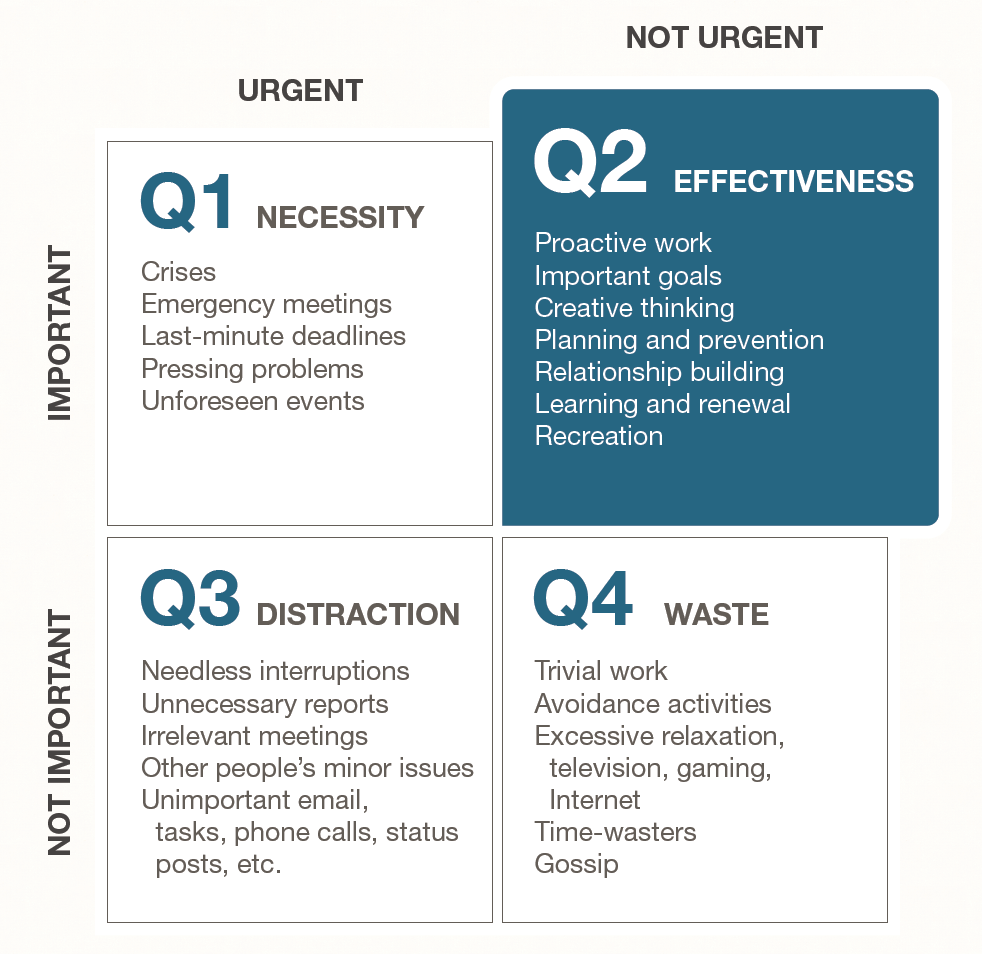

Habit 3: Put first thing first

As real estate investors you have a myriad of to do’s. Priority is key. Break out everything you have to do into a 2×2 matrix, one axis labeled important vs not important and the other axis labeled urgent vs not urgent. We don’t have any problems with quadrant one the important and urgent tasks and although it might take some discipline for the most part we know to tune out the not important and not urgent time waster. However, as investors we often overspend our time in the not important but urgent quadrant and under invest in quadrant two, the important but not urgent items that will pay much more dividends down the road. We need to delegate or decline the busy work and focus on what will sustain our business in the long run and that is building relationships with brokers, agents, and various trades.

Habit 4: Think Win-Win

Most investors are deal junkies but we must take the long view. Win/lose situations don’t build trust over time. You might want to ask the agent or broker to reduce their commissions but you have to realize the pie is big enough for everybody. The reason it is hard is because it takes tremendous amount of integrity, maturity, and most of all, empathy. When you are able to do that you bet you will get tons of repeat business in the future.

Habit 5: Seek First to Understand Then to Be Understood

Listen first. Ask questions. Too often are we ready to jump in to defend our position in negotiations or apply our own lens to the problems we miss out on the opportunity to peel back the onion to get at the deeper rooted issues. Per Aaron Burr’s advise in the musical Hamilton: “Talk less. Smile more.”

Habit 6: Synergize

What if 1 + 1 = 3 or 30? Often in complicated deals require innovative solutions. Could you maybe work out a seller financing option or installment sale? Would an option contract make more sense for both parties? It’s not about your way or my way or even a compromise; it is about finding our way.

Habit 7: Sharpen the Saw

We must remember there’s more to life than money. Money is just a funny way of keeping score. What is the point of working yourself to death? Take care of your body, heart, mind, and spirit to periodically recharge and you’ll actually achieve your peak performance better.