I recently shared my thoughts on the whole COVID-19 situation in our monthly newsletter and received tons of positive feedback so I figured I’d publish it here for wider readership. If you’re interested in hearing about market feedback and what we’re up to as a company drop me your email and I’ll add you to the list. I initially help off on sending the newsletter out because I wanted to get more info and formulate my own independent and hopefully intelligent response. A lot has changed even just in the 5 days since I sent it out. I will provide some updates at the end.

I’ve been speaking to lots of smart people in the healthcare and biotech industry. The hard part is that there is so much we don’t know yet and frankly it’s hard to know how much we should trust the news. There seems to be two camps of reaction: one that believes the world is coming to an end and 70% of the world population is going to die vs. one that think is nothing compared other diseases just wash your hands more often.

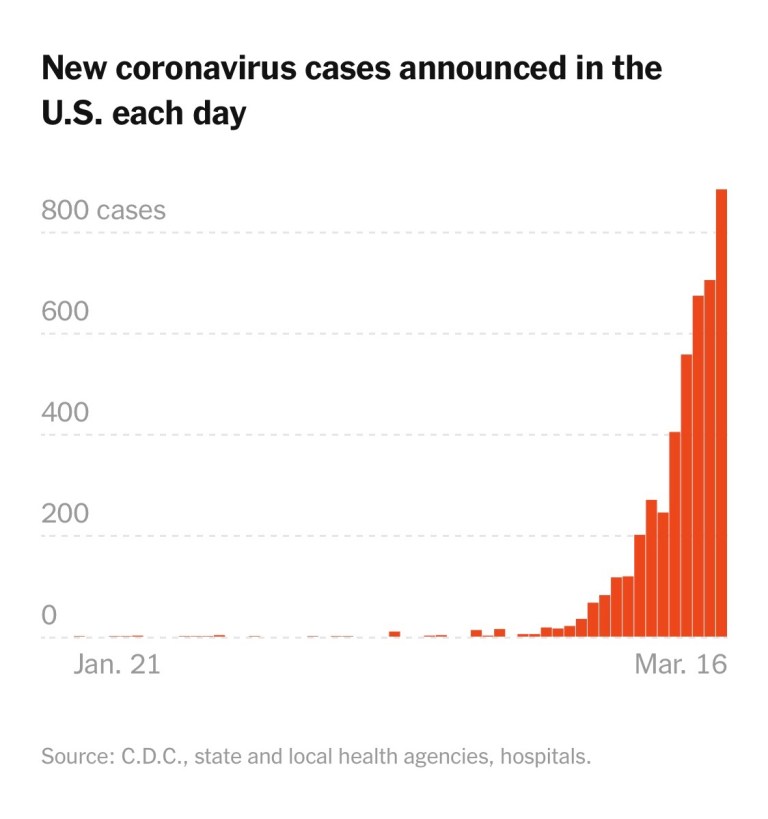

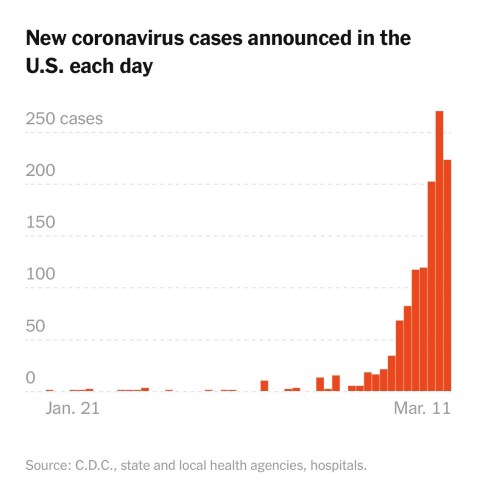

In times like this it’s useful to look at the numbers not in absolutely, but in trends and in context. This and next week I will be monitoring closely the cases in the US. We’re absolutely at a critical tipping point. I did find myself switched from “this is nothing” to “this is something” after tracking recent numbers. The number of new cases are in fact growing exponentially, resembling a hyperbolic function. However, with the lack of testing in the US these numbers could be way off but that has to be the starting point for us–getting more test kits manufactured and getting tons of people tested.

Personally I do believe it will be contained. Some of my sources believe it will stabilize in 2-3 months. The question remains how drastic will the method be to rein this back in control and what will be the economic impact. The markets will freak out in the mean time but it will be temporary. In short, it’s going to get worse and then it’s going to get better. I do not recommend buying the dips right now. Personally, I’m about 60% cash in my portfolio right now, much more than the 1/3 average I usually hold and I don’t plan to do anything until Easter. Below are what I do know:

The Good

- China is stabilizing. About 40% of the factories are back online. I in fact placed an order recently for some enamel pins we’re planning to give away as prizes and the rep did say things are getting back to normal.

- Death rate is much lower. The current estimate is around 3%. For context SARS back in 2002-2003 was around 10% and MERS was ~35%. Much of those infected with COVID-19 have also recovered.

- It’s only affecting a certain demographic.

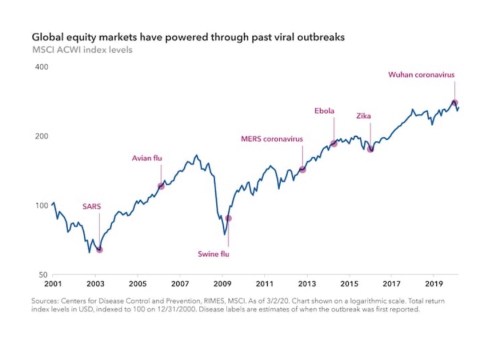

- We’ve been through this before.

The Bad

- Incubation period is longer compared to other outbreaks. You can go longer undetected and infect many more people in the process.

- Vaccine is in process, but due to required trials it probably won’t be widely available until the end of the year at best.

- If virus mutates that vaccines is useless, you have to start over the process.

- Not enough test kits. I’d laugh if the consequences aren’t so scary. Seriously, how do you identify the wrong virus starting out and it’s been weeks since we saw the first case in the US.

Absolutely there will be investment opportunities. I have my shopping list ready but until I see the number of new cases decrease I’m sitting on my hands. I’m not a financial advisor and my Series 7 license expired long ago so please do your own research. Look at the supply and demand. Since I’ve been getting so much requests here’s what’s on our radar:

- Clorox (CLX) and Costco (COST) – duh

- Moderna (MRNA) – They’re leading the race on vaccines right now. Doesn’t mean they’ll end up winning the race though but they also do have some other interesting stuff in the works. BTW, you’re going to see a lot of egg shortage in your grocery stores so stock up bc the egg whites are used for vaccine testing and production. Full disclosure: we have a small position in MRNA.

- Thermo Fisher (TMO) and Roche (RHHBY) – TMO recently acquired QIAGEN which makes test kits for COVID-19 so is Roche. TMO also makes many of the lab testing equipments which is sure to be in high demand. The QIAGEN acquisition should be a slam dunk for them. Although at 32 P/E ratio TMO gives me some pause.

- Good companies getting beat up – I like me some Uniliver (UN), McCormick (MKC), Disney (DIS), Shopify (SHOP), Prologis (PLD).

- Not touching it with a ten foot pole but might later – Oil, airlines, food companies. I particularly like my Chipotle (CMG) that was a handsome patient hold for us and McDonald’s (MCD). I normally hate airline stocks but I might be convinced for some Southwest (LUV) bc they’re more domestic oriented and operationally sound. Historically they’re also better at hedging their fuel costs so I bet they’re out there securing good oil futures contracts right now.

Update

Below is the latest figure of new cases in US. Clearly not getting any better. Certain parts of the world is like this we’re still seeing accelerating new cases vs recovered patients. Don’t catch a falling knife folks.